Comments on results of Stalexport Autostrady Group in 2023H1

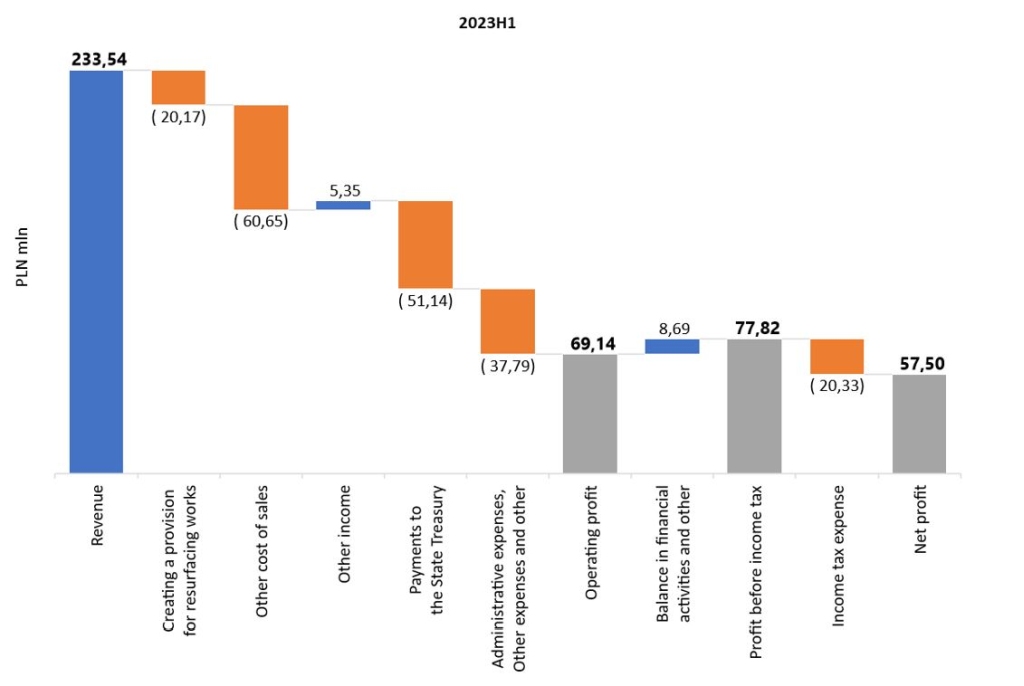

Aktualności EN 29 September 2023In 2023H1 Group’s revenue amounted to PLN 233,543 thousand and increased by 24.4% compared to 2022H1 (PLN 187,720 thousand), mainly due to increase of revenue from management and operation of motorway (increased by 24.4%), including toll revenue (increased by 24.4%) on the toll section of A4 Katowice-Kraków motorway (see detail report here).

In 2023H1 Group’s cost of sales (PLN 80,827 thousand) decreased by 38.9% compared to 2022H1 (PLN 132,356 thousand), mainly as a result of lower costs of provision for resurfacing works.

In comparison to 2022H1 (PLN 2,718 thousand), Group’s other income in 2023H1 (PLN 5,348 thousand) increased by 96.8%, mainly due to reimbursement of costs of protection against the effects of mining damage and an increase in interest from receivables. In the same period the Group recorded administrative expenses (PLN 88,690 thousand) at higher level (increased by 218.8%) than in H1 of last year (PLN 27,817 thousand), which is mainly due to "Payments to the State Treasury" in the amount of PLN 51,142 thousand in the current period, with no such cost in the comparative period.

With reference to the above, in the comparative period the company updated costs of works related to the motorway resurfacing, which it is obliged to carry out by the end of the concession period. As a result of these activities, the resurfacing reserve account was topped up with a higher amount than in previous years, which in turn resulted in the lack of funds constituting the basis for calculating the "Payments to the State Treasury".

Other expenses in 2023H1 in the amount of PLN 230 thousand were lower than those in 2022H1, when they amounted to PLN 262 thousand, mainly as a effect of lower donations granted. Impairment losses on trade and other receivables in 2023H1 amounted to PLN 9 thousand, compared to PLN 3 thousand in the first quarter of previous year. In consequence the results from operating activities in 2023H1 amounted to PLN 69,135 thousand and were higher (increased by 130.5%) than those achieved in 2022H1 (PLN 30,000 thousand).

The Group recorded positive balance in financial activities in 2023H1 (PLN 8,621 thousand) in contrast to the negative balance in 2022H1 (PLN 3,723 thousand). This result is the combined effect of higher interest income on cash and non-current deposits but also higher costs of discounting provisions mainly due to increase in the interest rates. As a result of the above, profit before income tax in 2023H1 amounted to PLN 77,823 thousand and was higher (increased by 195.5%) than the one achieved in 2022H1 (PLN 26,339 thousand).

As a result of activities in 2023H1 Group achieved net profit at the level of PLN 57,495 thousand, which is at higher level (increased by 260.8%) when compared with the net profit in 2022H1 (PLN 15,935 thousand).

It should be mentioned that the data for the comparative period were restated in connection with the changes described in note 5 to the consolidated financial statements.

Separate and consolidated condensed interim financial statements of Stalexport Autostrady for 2023H1 can be found here.